Quinto

The deck is stacked!

I have heard dozens of traders lament that the market is fixed.

I have heard dozens of traders lament that the market is fixed.

They believe the deck is stacked against them.

I have a very different view of the market.

I believe the market is designed to pay you money.

I agree the market is fixed – that the deck is stacked.

It is stacked in your favor if you do three things:

The market has the memory of a dog!

Everyone I know who owns a dog thinks that their dog is the smartest dog that ever lived.

Everyone I know who owns a dog thinks that their dog is the smartest dog that ever lived.

They think their dog remembers everything that happens.

Take my neighbor’s dog Fritz as an example. Fritz is smart, but his short term memory is hazy at best and his long term memory is almost nonexistent. The markets have a memory just like Fritz.

The more in the past a price is, the less likely it is to be helpful in making trading decisions.

However, just like a dog owner’s belief that his dog remembers things, many traders memorize past prices in the hope that the market will repeat itself in the future.

Traders have told me triumphantly that the market bounced off last Tuesday’s lows or rallied to Friday’s high.

Maybe it did.

Futures trading attracts traders looking for action, but rewards traders who have patience

To view the contents of this post, you must be authenticated and have the required access level.

What to learn from the giant tree looming over our house when it gets hit by lightening?

![]() I asked Andre what could be learned from the recent lightening and wind damage to a giant walnut tree next to my house. Truth be told, I wanted to have an excuse to use the photo-shopped picture at the left.

I asked Andre what could be learned from the recent lightening and wind damage to a giant walnut tree next to my house. Truth be told, I wanted to have an excuse to use the photo-shopped picture at the left.

Thanks Andre.

“The market is like the weather, unpredictable and sometimes very volatile. The tree represents an overall position in the market and the branches, contracts in different markets. No branch is the same on a tree and similarly and, hopefully, the contracts are in non-correlated markets.

The tree is a beautiful tree providing shade for the trader and his house and it took years for it to grow to its current size. Read the rest of this entry »

Over-reliance on accuracy in trading can be dangerous!

In many professions, it is the most important thing.

In many professions, it is the most important thing.

(see picture at left)

However, in trading, over-reliance on accuracy can actually be destructive.

A new mentoring trader started with me last week and he showed me a strategy he had learned that generated 80% winning trades.

80% winning trades – that seems too good to be true.

Could there be a catch?

As we discussed the strategy in greater detail, he showed me the setups which seemed very reasonable – in fact the setups were quite clever.

But, then, he told me about the Read the rest of this entry »

Making the best of the worst of times

I was the favorite grandchild of my larger-than-life grandfather. Read the rest of this entry »

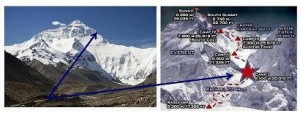

Getting from the Foothills of Trading to Base Camp One

At last week’s $aturday $trategy $ession, two traders in my Professional Trader Mentoring Program talked about their path from the foothills of trading to Base Camp One.

The Mount Everest analogy is meant to describe the journey from getting serious about trading, the foothills, to the start of professional trading, Base Camp One.

The first trader who talked about his journey to professional trading was Khasan from Moscow. Khasan presented a Read the rest of this entry »

Simon’s Eureka Moment

To view the contents of this post, you must be authenticated and have the required access level.

May you live in interesting times

To view the contents of this post, you must be authenticated and have the required access level.

Combining Disparate Timeframes – Simon shows how

A popular topic in trading circles is the use of multiple timeframes.

Lots of traders like to use more than one timeframe to support their hypotheses and used properly such techniques can have considerable benefits.

However most proponents use relatively similar timeframes and in my opinion in doing so they are missing the true value of such an approach.

I like to use truly disparate timeframes, ones that are radically different to each other.

Copper last week gave us a timely example of this, so let’s use a real life example to illustrate the power of this often misunderstood concept. We will start with a daily chart of copper…

Our strategy gave us a buy signal at Read the rest of this entry »