Uncategorized

Mentoring for Already Successful Traders

First, in 8-10 one-hour meetings, I make an assessment of a trader’s experience and his problems.

For experienced, already successful traders, the trader and I design a program that begins with the trader’s already successful trading strategies and adds opportunistic trade sizing, structured risk management, and trader accountability strategies to help the experienced trader move his trading to the next important level in terms of profitability and consistency.

Four-day-a-week meetings for four weeks:After our 8 one-hour Foundation Meetings, we will speak for half an hour each day, Monday through Thursday, for the next four weeks. During each day’s meeting, we will go over a chart marked with the trades the trader took, establish strategies for improvement, and make an outline for the next day. Our goal during these four weeks is for the trader to become competent and confident in executing our mutually-developed Trading Plan. In many of these sesssions, we will trade together during the live market session with you placing the trades and me coaching you live, one-on-one.

Twice weekly meetings for 12 weeks:After the four week, four-day-a-week half hour sessions, we will have established our plan and our goals. For the next 12 weeks, the trader and I will meet twice a week to move his trading forward: hone his understanding of the market; establish and monitor his discipline; oversee his implementation of the agreed Trading Plan; and make plans for the trader’s long term growth.

After the completion of the program, outlined above, I remain available for ongoing coaching and consultation on an hourly basis.

My backgroundI have spent my entire adult life in the futures trading business. Coaching professional traders is the exciting and rewarding culmination of my career in futures trading. I do not know of anyone with my extensive, long-term successful background in futures trading who coaches traders. Nor do I know anyone who has my track record of success with futures traders.

What I look for in new mentoring tradersAs new mentoring program traders, I look for traders:

- who have a good chance of reaching meaningful, consistent success in futures trading;

- who I will likely be able to help reach their trading goals; and

- who will be enjoyable and stimulating for me.

Cost of the program

The cost of the Mentoring Program is $6,000, which can be paid $3,000 to start followed by two payments of $1,500 payable in 30 days and 60 days, thereafter. After the initial 48 sessions, I am available as a mentor on an hourly basis with the trader buying blocks of 5 hours for $1,500. Mentoring charges are payable in advance and may be paid by check, bank wire or by Visa, MasterCard or Discover through PayPal, below.

One-on-one Mentoring with Jeff Quinto First payment for Mentoring $3,000.00 Second or Third Mentoring payment $1,500.00 Hourly (5 hours, 10 sessions) $1,500.00Is Jeff’s Mentoring worth the price? I think the price is too low. Gregor Cotman, Slovenia

If you should have any questions not answered above, click here to see Ten Questions: Everything you wanted to know about Jeff’s mentoring.

In summaryI help traders to be their best by implementing rational trading strategies within a risk framework that attempts to quantify and limit losses and exploit opportunities. I love coaching traders and I am pleased to have dozens of traders from around the world who started as Electronic Trader Mentoring Traders and have become better traders and my friends.

E-mail me or call me at +1-312-685-5333 and let’s talk about taking your trading to the next level.I look forward to hearing from you.

Wishing you success in your trading,

Jeff

Jeff Quinto Professional Trader Mentoring Inc. Jeff@professionaltradermentoring.com +1-312-685-5333Derivative transactions, including futures, are complex and carry a high degree of risk. They are intended for sophisticated investors and are not suitable for everyone.

As a veteran trader I was skeptical that someone else could do this for me – but he did! … Is his mentorship worth the money? Well, I have been profitable every single month, except one, since, so I’d say it was a darn good investment!” Simon Townshend, England.

Barry Crockett’s recommendation

I have been trading for a couple of years, attempting to teach myself without much success. I’ve always been able to turn a profit, but never able to hold onto my gains inevitably I gave it all back and then some… generous soul that I am. Upon learning of Jeff Quinto’s Mentoring Program, I subscribed immediately. After he untangled some of my messy trading ideas I started to see positive results almost immediately. Jeff has a unique ability to impart his vast experience in a clear, concise manner along with a good dose of humor. He immediately sets you on the correct course – build a business plan, define trading objectives, address your trading issues, meet head on and resolve all those “little whispers” running around in your head… doubt… fear… greed… indecisiveness… frustration… and more.

I believe the most powerful aspect of Jeff’s program is the one-on-one sessions (52 of them). Each day he reviews your trades. He zeros in on the real issue immediately focusing you on the best solution. Jeff has an amazing wealth of knowledge and experience in the markets. He is uniquely qualified as Coach and Mentor using this knowledge and keen market intellect as building blocks necessary to strengthen your trading skills. It bears repeating his wonderful sense of humor and humility is a breath of fresh air.

I am about two thirds through the program and I can see dramatic improvement. I know this will become a long term relationship as I continue to use Jeff’s Mentoring services.

Thank you for a truly valuable program, Barry N. Crockett

Chris from Sonoma recommendation

I had done newsletter investing for many years. But had grown tired of simply watching choices being made for me and wanted to learn more about the markets by doing some day trading. So, I put a lot of my spare time into reading, studying and attending various trading and psychological transformation seminars. Eventually I felt ready. My day trading adventure lasted all of twelve trading days before I decided to lick my wounds and save my remaining trading capital. Something very essential was missing and I thought a trading coach might help me identify how I to improve my trading. So, I sifted through the many coaching and mentoring offerings mentioned in trader’s forums, on the web and those I ran into through word of mouth. Eventually, through a very respected source, I found Jeff’s website. I was immediately drawn to the structure of his program and his long experience, directly trading in the markets. But I only decided to sign up after talking to him about his systematic and continuous improvement approach trading. “So here we are.” These words often start our sessions and have come to represent for me Jeff’s direct, yet subtle mentoring style. For to me, this phrase reminds me to stay focused, attend to the market, my trading plan, and move beyond excessive judgments about “mistaken trades.” Now, four months into the program, Jeff has helped me create my own unique personal trading approach and a confidence to trade the e-minis successfully. It is not because he handed me the perfect setup or a magic indicator. It is because he helped me cultivate an understanding to recognize where to place the trade, when to get out and develop a courage to stay in. I can’t say this process was easy, that it matched any of my preconceived ideas about trading or that I have nothing left to learn. I can only say that this very satisfying place in my trading journey would not have been possible without Jeff’s experienced guidance, warm personality and wonderful sense of humor. He really has a great knack for working at one’s own level of understanding and pace.

Jeff, I am grateful for your teachings and look forward to our continued relationship.

Chris S., Sonoma County

Everything you wanted to know about Jeff Quinto’s Professional Trader Mentoring Program and the Express Program, but were afraid to ask.

1. Why do I need a mentor?

Would you feel comfortable riding in an airplane flown by a pilot who learned to fly by trial and error?

Would you be confident in a doctor who read every book on medicine, but never studied under another doctor?

Of course not, you would expect the pilot and the doctor to be thoroughly trained, not just by trail and error or from reading books, but from hands-on training from senior pilots and experienced doctors. In the same way, a trading mentor can help you dramatically advance in your trading in ways that you could not advance on your own.

By working with a mentor, you can take advantage of his years of experience without having to take years to get that experience. The right mentor can give you an edge that other traders without mentors do not have.

2. How much experience should I have?

There are traders in the program who have only modest experience as well as veteran traders with years of successful trading experience who manage significant accounts. New traders should understand the basics of the futures markets and be committed to learning. New traders may not have much experience, but they, also, do not have bad habits that need to be broken.

3. Do I need to come with my own setups and trading plan?

No, I have a series of setups that I give mentoring traders if they do not have their own setups or if they are not confident in the setups they have been using. If you have been successful using your own setups, then we will design a trading plan to maximize your results using your setups. My goal is to help you find your own path to further success.

4. Can I talk to other traders who have gone through the program?

Absolutely, there are traders who have been though the program who are happy to speak to new potential mentoring traders. Also, you can click on the Trader Testimonials tab to read what other traders think of their experience working with me.

5. Is the program customizable for me in terms of time and content covered?

Absolutely, one of the reasons for the series of meetings before we even get started is to design a program that makes the most sense for the trader given his schedule, his goals and his needs.

6. How much does it cost and how do I pay for it?

The 48-session Professional Trader Mentoring Program is $9,700, if paid in advance, or it may be paid in three monthly installments of $3,497, if more convenient. Mentoring charges are due in advance and can be paid by credit card or bank transfer through PayPal or they may be paid by check made out to: Jeff Quinto’s Professional Trader Mentoring and sent to: Jeff Quinto, 608 Birch Blossom Road, Verona, WI 53593.

7. What is the 20-Session Professional Trader Mentoring Program?

For experienced futures traders, Jeff offers a 20-session Professional Trader Mentoring Program which is designed for experienced traders who do not need the full mentoring program. It is expected that this would be a stand-alone program for most experienced traders. The program starts with an in-depth understanding of the methodology the trader uses and, then, proceeds to refine and improve that methodology. In most cases, the risk management employed by the trader would be significantly upgraded during the 20-sessions. This program is available on a case-by-case basis for a single payment of $4,995.

8. What if I go on vacation or have work commitments during the Mentoring Program?

The Professional Trader Mentoring Program includes 48 one-on-one sessions with me and the 20-Session Professional Trader Mentoring Program for Experienced Traders includes 20 one-on-one sessions with me. There is no penalty if the trader misses a session as long as he notifies me in advance. In this way, traders in the program can attend to non-trading business without being penalized.

9. What can I do to continue my mentorship with Jeff after I have completed the program?

After the initial one-on-one sessions with me, Mentoring Traders can elect to continue their mentoring with me on a per-session basis of $1,500 for five hours. Many traders speak with me for an hour once a week or once a month.

10. What is expected of me?

I expect traders to be committed to success in their trading. I am willing to design the program to match the trader’s time constraints, as well as his work and personal responsibilities and I expect the trader to be as committed to his success as I am.

For any further questions, please contact Jeff Quinto directly at Jeff@JeffQuinto.com or call him at +1-312-685-5333

Gregor Cotman’s recommendation

I started working with Jeff Quinto in December 2008. I was already several years into the business of trading. My trading was profitable before I met him, but I knew there is much more to learn so I wanted to take my trading career to the next level.

Working side by side with Mr. Quinto for last few months was really a joyous experience. I must tell you that he is a real professional with unbelievable patience and kindness. My trading results when working with him were 2 profitable months out of 3 and a profit overall. He really taught me more than my ego likes to admit.

If you are thinking about whether Mr. Quinto should be your mentor and if he can help you, please read his Bio. It is really amazing. I think one sentence from one of his e-mails says it nicely: “You can get the benefit of my 37 years in futures trading business without taking 37 years to get it.”

Is that worth the price? I think the price is too low. I thank Mr. Quinto for offering us his services.

Also, I want to mention that the student is the one who will have to do the work and the mentor can only guide him. It’s like a bodybuilder going to the gym and expecting his coach to lift the weights, instead of him. No. You will have to lift those weights, but he can advise you how to do it the easiest, smartest and faster way! If you will only listen.

I am looking to continue working with Mr. Quinto in the future since I find him to be an invaluable trainer and advisor on my trading team.

Gregor Cotman, Slovenia

John B’s description of his experience working with Jeff

Just to let you know, I am totally rejuvenated now. MY mindset has changed 180 degrees on some money management concepts I always steadfastly resisted before. My “contrarianism” was useful for me before to build total confidence and self reliance in my scalping strategies. But now I clearly recognize the need for much more intelligent structuring of risk control as a higher priority than I gave to it previously. The bonus I now see for my strategizing, is that the improved structure facilitates much better “bang for the buck” in terms of potential for every contract I put on.

Also, it opens up the advantages of trading other contracts, such as the Russell, Dow, and Dax. Now I evaluate my plan for any market with the emphasis on how to work the money management, with totally different possibilities emerging from the entry exit parameters.

Although I came to you primarily to find ways to better define risk, and to grow in capability for advantages of more profitable position sizing, I am finding that your mentoring has benefited all the other aspects of my trading—-strategies, precision, aggressiveness, limits to risk, better gain per contract and per trade, and so on down the list. The biggest bonus is, it seems to have opened up a flood of creativity and a freedom from “ruts”.

It is quite remarkable for me to see all the effects from the process you facilitate so effortlessly and skillfully. But now as I experience it, it all makes sense. You are like a rock, grounded in the most important principles which ensure intelligent trading. So no matter what I could throw at you, you could always logically frame my perspectives against the back drop of simple trade management principles.

Little by little I started to see a vastly expanded set of variables as a framework for my own good and bad habits in trading. Somehow, out of this process, it becomes much easier to just drop anything which is too questionable in its value.

It appears you are really good at guiding the horse to the vicinity of the water, but instead of trying to make him drink, this horse can’t wait to dive in the water. That reflects great teachership. Because most likely anyone could tell me (probably like most traders) anything, but I would never get it, unless I work through it for my own conviction. Your skill and experience mentoring, drawing out the discoveries, seems to result in the effortless accomplishment of all the objectives.

Thank you so much for your wonderful guidance, support, and sharing of so much. I am looking forward to great things to report in my progress and further work together down the road.

Print This Post

Print This Post

Recommendation of William from London

Jeff has been my mentor for 8 months now. I first started as a participant in his mentoring program. This phase lasted 3 months, during which I talked to him on a daily basis. I am now talking to him twice a month.

When I first contacted Jeff, I had been researching trading strategies for some time. In addition, I had been working in the industry for 3 years. I started my career on the execution trading desk of a major US investment bank in Tokyo, and I am now working as an analyst for a hedge fund in London. Despite the appearance, I did not find these jobs fulfilling, and I wanted to go on my own and become a successful independent trader.

I contacted Jeff, and our first discussion gave me a very good impression. Jeff was very friendly, and I could feel that he had a real passion for coaching younger traders and helping them become more successful. When we hung up, I knew that I would be able to learn a lot from him, and that it would be fun. And the actual experience exceeded these expectations.

Naively, I thought at the beginning that he would teach me a strategy with an edge that would easily turn me into a profitable trader. This naive thinking was the result of what we are taught in school, and later at work – learn the method well from your teacher/boss, execute it without mistake, and you will be rewarded. Trading is very different, and Jeff really helped me understand this.

He did give me a framework to work from, but it was just a starting point, from which he helped me discover and craft a unique trading strategy adapted to my personality and way of looking at the market.

More than teaching me a system, Jeff helped me understand trading and the mindset that goes with it. This is the most valuable thing for a beginner, and it helped me develop quickly and avoid a lot of costly mistakes.

At the beginning, we covered the basics – his view of the markets, and the basic rules that a trader should observe to maximize his chances of success. Every day, I drew on my charts the trades I had made on the simulator, and Jeff gave me feedback on each trade. This interaction was extremely valuable, as it showed me how a successful trader thinks, and instilled in me the right mindset and attitude.

I believe that what differentiates consistently profitable traders to consistent losers is the mental attitude, and this is the most valuable thing I learnt from Jeff.

At the beginning, Jeff also helped me write my trading plan, and as my trading developed and more questions came up (such as, for instance, shifting from a system with fixed profit targets to flexible profit targets, how to improve the profit/loss ratio, how many contracts I should trade, how large should the account be, maximum daily / weekly / monthly losses, etc.), he was there to discuss and guide. He also helped me write a very precise and logical trading plan, which had a very positive impact on my trading.

At the beginning, I was making more than 20 trades in the afternoon session, and was consistently losing money. My trading was relatively random, not disciplined, and characterized by psychological pain.

Now, I am consistently profitable, and the pain is gone – trading has become fun and rewarding. This could happen in 8 months thanks to Jeff’s guidance and dedication. I still have a lot of work from here, and a lot to learn from Jeff. Our bi-monthly discussions are as interesting and beneficial as our first meetings. I think any person seriously considering trading as a profession should learn with a mentor, and Jeff is definitely one of the best out there.

Print This Post

Print This Post

Risk Disclosure Statement for Futures and Options

This brief statement does not disclose all of the risks and other significant aspects of trading in futures and options. In light of the risks, you should undertake such transactions only if you understand the nature of the contracts (and contractual relationships) into which you are entering and the extent of your exposure to risk. Trading in futures and options is not suitable for many members of the public. You should carefully consider whether trading is appropriate for you in light of your experience, objectives, financial resources and other relevant circumstances.

Futures

1. Effect of “Leverage” or “Gearing”

Transactions in futures carry a high degree of risk. The amount of Initial margin is small relative to the value of the futures contract so that transactions are ‘leveraged’ or ‘geared’. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit.

2. Risk-reducing orders or strategies

The placing of certain orders (e.g., “stop-loss” orders, where permitted under local law, or “stop-limit” orders) which are intended to limit losses to certain amounts may not be effective because market conditions may make it Impossible to execute such orders. Strategies using combinations of positions, such as “spread” and “straddle” positions, may be as risky as taking simple “long” or “short” positions.

Options

3. Variable degree of risk

Transactions in options carry a high degree of risk. Purchasers and sellers of options should familiarize themselves with the type of option (i.e., put or call) which they contemplate trading and the associated risks. You should calculate the extent to which the value of the options must increase for your position to become profitable, taking into account the premium and all transaction costs. The purchaser of options may offset or exercise the options or allow the options to expire. The exercise of an option results either in a cash settlement or in the purchaser acquiring or delivering the underlying interest. If the option is on a future, the purchaser will acquire a futures position with associated liabilities for margin (see the section on Futures above). If the purchased options expire worthless, you will suffer a total loss of your investment which will consist of the option premium plus transaction costs. If you are contemplating purchasing deep-out-of-the-money options, you should be aware that the chance of such options becoming profitable ordinarily is remote. Selling (“writing” or “granting”) an option generally entails considerably greater risk then purchasing options. Although the premium received by the seller is fixed, the seller may sustain a loss well in excess of that amount. The seller will be liable for additional margin to maintain the position if the market moves unfavorably. The seller will also be exposed to the risk of the purchaser exercising the option and the seller will be obligated to either settle the option in cash or to acquire or deliver the underlying interest. If the option is on a future, the seller will acquire a position in a future with associated liabilities for margin (see the section on Futures above). If the option is “covered” by the seller holding a corresponding position in the underlying interest or a future or another option, the risk may be reduced. If the option is not covered, the risk of loss can be unlimited. Certain exchanges in some jurisdictions permit deferred payment of the option premium, exposing the purchaser to liability for margin payments not exceeding the amount of the premium. The purchaser is still subject to the risk of losing the premium and transaction costs. When the option is exercised or expires, the purchaser is responsible for any unpaid premium outstanding at that time.

Additional risks common to futures and options

4. Terms and conditions of contracts

You should ask the firm with which you deal about the terms and conditions of the specific futures or options which you are trading and associated obligations (e.g., the circumstances under which you may become obligated to make or take delivery of the underlying interest of a futures contract and, in respect of options, expiration dates and restrictions on the time for exercise). Under certain circumstances the specifications of outstanding contracts (including the exercise price of an option) may be modified by the exchange or clearing house to reflect changes in the underlying interest.

5. Suspension or restriction of trading and pricing relationships

Market conditions (e.g., illiquidity) and/or the operation of the rules of certain markets (e.g., the suspension of trading in any contract or contract month because of price limits or “circuit breakers”) may increase the risk of loss by making it difficult or impossible to effect transactions or liquidate/offset positions. If you have sold options, this may increase the risk of loss. Further, normal pricing relationships between the underlying interest and the future, and the underlying interest and the option may not exist. This can occur when, for example, the futures contract underlying the option is subject to price limits while the option is not. The absence of an underlying reference price may make it difficult to judge “fair” value.

6. Deposited cash and property

You should familiarize yourself with the protections accorded money or other property you deposit for domestic and foreign transactions, particularly in the event of a firm insolvency or bankruptcy. The extent to which you may recover your money or property may be governed by specific legislation or local rules. In some jurisdictions, property which has been specifically identifiable as your own will be pro-rated in the same manner as cash for purposes of distribution in the event of a shortfall.

7. Commission and other charges

Before you begin to trade, you should obtain a clear explanation of all commission, fees and other charges for which you will be liable. These charges will affect your net profit (if any) or increase your loss.

8. Transactions in other jurisdictions

Transactions on markets in other jurisdictions, including markets formally linked to a domestic market, may expose you to additional risk. Such markets may be subject to regulation which may offer different or diminished investor protection. Before you trade you should enquire about any rules relevant to your particular transactions. Your local regulatory authority will be unable to compel the enforcement of the rules of regulatory authorities or markets in other jurisdictions where your transactions have been effected. You should ask the firm with which you deal for details about the types of redress available in both your home jurisdiction and other relevant jurisdictions before you start to trade.

9. Currency risks

The profit or loss in transactions In foreign currency-denominated contracts (whether they are traded in your own or another jurisdiction) will be affected by fluctuations in currency rates where there is a need to convert from the currency denomination of the contract to another currency.

10. Trading facilities

Most open-outcry and electronic trading facilities are supported by computer-based component systems for the order-routing, execution, matching, registration or clearing of trades. As with all facilities and systems, they are vulnerable to temporary disruption or failure. Your ability to recover certain losses may be subject to limits on liability imposed by the system provider, the market, the clearing house and/or member firms. Such limits may vary: you should ask the firm with which you deal for details in this respect.

11. Electronic trading

Trading on an electronic trading system may differ not only from trading in an open-outcry market but also from trading on other electronic trading systems. If you undertake transactions on an electronic trading system, you will be exposed to risks associated with the system including the failure of hardware and software. The result of any system failure may be that your order is either not executed according to your instructions or is not executed at all.

12. Off-exchange transactions

In some jurisdictions, and only then In restricted circumstances, firms are permitted to effect off-exchange transactions. The firm with which you deal may be acting as your counterparty to the transaction. It may be difficult or impossible to liquidate an existing position, to assess the value, to determine a fair price or to assess the exposure to risk. For these reasons, these transactions may involve increased risks. Off-exchange transactions may be less regulated or subject to a separate regulatory regime. Before you undertake such transactions, you should familiarize yourself with applicable rules and attendant risks.

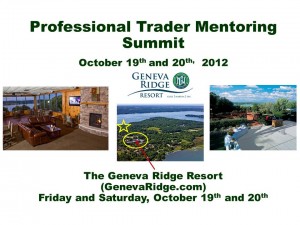

Events

The Professional Trader Summit on October 19th and 20th is open to traders in Jeff’s Professional Trader Mentoring Program

________________________________________________

June $aturday $trategy $ession is set for June 23rd at 10:00AM CST

The Professional Trader Summit in Lake Geneva on October 19th and 20th is open only to traders in Jeff’s Professional Trader Mentoring Program.

Finding success by finding failure patternsJeff will explain how understanding failure patterns can help you be more successful.

$aturday $trategy $essions are private monthly webinars exclusively for traders in my Professional Trader Mentoring Program.

________________________________________________

July $aturday $trategy $ession is set for July 21st at 10:00AM CST

Option Guru Extraordinaire Mark Sebastian Using Options as a Substitute for Futures________________________________________________

________________________________________________

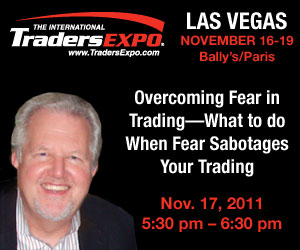

Past Events Trader’s Expo in Las Vegas on November 17th was a blast!

Thanks to everyone who attended my Overcoming Fear session – you were the best group ever!

Now, don’t be afraid – give me a call and take your trading to the place your deserve in 2012!

Trader’s Expo in Las Vegas on November 17th was a blast!

Thanks to everyone who attended my Overcoming Fear session – you were the best group ever!

Now, don’t be afraid – give me a call and take your trading to the place your deserve in 2012!

________________________________________________

Thursday, October 13th at 3:30PM CST

Join Jeff Quinto for this live webcast sponsored by the CME Group and Mirus Futures introducing his theory and outlining how you can design your own to serve as the foundation of your trading.

Designed to help you become a consistent trader over the long term, your unique theory of trading can define how you believe the market operates and outline how you are going to capitalize on the opportunities the market presents.

You can register by clicking here.

________________________________________________

________________________________________________

Saturday, July 9th at 10:00AM CST – $aturday $trategy $ession

How to handle the really BIG marketsWhen I talk about really BIG markets I am not talking about just good markets, I am talking about “driving your Bugatti down Rodeo Drive” BIG markets.

I am certainly not predicting when big markets are coming, but I will show you what to do when they do come in the July 9th $aturday $trategy $ession.

________________________________________________

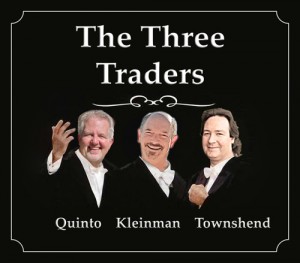

Saturday, June 25th in Sunny Southern California A Century of Trading - The Maestros were in Santa Monica

A Century of Trading - The Maestros were in Santa Monica

Simon Townshend, George Kleinman and me in Santa Monica, California at the Huntley Hotel on June 25th when we bring our 100 years of trading experience to a one-day seminar. Each of us will present two one-hour presentations followed by a three-man question and answer session that is sure to be a hit. For further information and to secure your place in this exciting event go to: CenturyofTrading.com.

Videos of the entire day – 6 presentations – will be available soon!________________________________________________

You can watch the March $aturday $trategy $ession! Danny Riley – Mr. Top Step himself – talked about trading S&Ps on the floor and on the screen

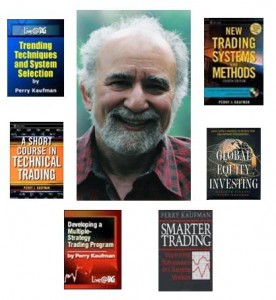

$aturday $trategy $ession The October $aturday $trategy $ession featured my friend, Systematic Trading Guru, best selling author – Perry Kaufman.

The October $aturday $trategy $ession featured my friend, Systematic Trading Guru, best selling author – Perry Kaufman.

Perry and I spoke about how to get started in systematic trading; how to develop trading systems; smart risk management; and how to back test and how to avoid the pitfalls of curve-fitting.

This incredible session was available at no additional charge to traders in my Professional Trader Mentoring Program.